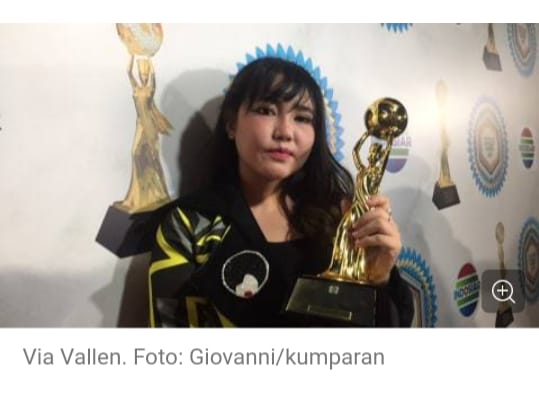

Bobot Tubuh Bertambah, Penampilan Via Vallen Bikin Pangling

Auto Insurance Specialists - Making All the Difference

These days getting car insurance is not an easy task. Finding it's but finding cheap insurance is not. It is now mandatory for a driver to get auto insurance. There are a few those who don't know how to shop for insurance and they go for just about any quote that will come in their way. This is actually the approach to paying a lot of and you wish to avoid that.

How Is it possible to avoid over paying on your own car insurance ? How to avoid this? Who will assist you to? This question often comes up.

There's a simple answer to all or any your questions. An auto insurance specialist could be of use. They are a person who can guide you to get the very best quotes. Policyholders can approach them to achieve proper information about the policy terms and condition.

Even if your person desires to investigate the value of the policy or know how much the coverage of his policy s is they can always call up insurance specialist and they will be the best person to offer answers to your questions.

They will ask you questions like what is your age, driving record etc and allow you to get the quotes in a minute. Unfortunately there is one small trouble with this. Insurance specialists either charge you or will sell you a policy for an organization they work for. So what else can you do?

The choice is by using online insurance comparison sites. All you want to complete would be to enter a couple of details and in minutes you are certain to get numerous quotes for car insurance and precisely each policy. You can do this from the comfort of one's living room without worrying all about being forced to worry with having a sales pitch given for your requirements every time you ask a question.

All you could normally need to do would be to enter your zip code and that is it. The main thing to consider listed here is that you mustn't take the very first quote you find. No matter how cheap it appears to be. Compare several of the lowest priced ones and go through the cover carefully. Make certain the deductible is the exact same and along cover is the exact same too. When you have done this you may be sure you will find the lowest priced car insurance cover at the very best price.

Taking Advantage of Your License

This indicates when someone knows that you've a license and a vehicle they become your absolute best friend. It could be because they might want a trip to school that will give them additional time to sleep in or a trip to the mall because they wish to hang out. There are people who will call you, even family members to see if you can pick them up from work or drop them off to work because their very own ride fell through.

Don't get caught in the trap of becoming a chauffeur to others. Not only will it become expensive but additionally it may put unwanted wear and tear on your own car. If they cannot offer you anything towards gas then you definitely are footing the entire bill of gas and auto insurance. What if you're in an incident? Does your policy have medical coverage? Do you have passenger coverage? Can you be liable or able to pay for their care?

They're a few of things that you've to think about everytime the device rings and someone asks you for a ride. Sometimes the worst offenders are family. Your parents are proficient at telling to pick up your siblings. Initially it's fun because you merely got your license however it becomes old because it ties up your time. Usually the one a valuable thing about parents is they normally offer you some funds for a reservoir of gas and you're probably already on the auto insurance policy.

When you tell your parents "no" you may want to go online and compare auto insurance rates to see what it would set you back to get your personal car insurance. You are able to view several companies previously and you'd have the ability to put a buck figure about what your parents are giving you monthly to operate some errands for them, like picking up your brother or sister from school. Sometimes picking up that occasional gallon of milk and loaf of bread is well worth that monthly premium. You might want to consider charging your pals for a trip every time they call.

How exactly to Make Yourself More Appealing to Insurance Companies

Let us first set aside a second to define "high risk driver ".This term describes anyone who's considered to become a risky investment. Whether you have been around in multiple accidents or been arrested for a DUI, insurance companies will view you as riskier to insure. Most high risk drivers have either gotten two or more points on the license or are merely considered risky due to their age. Either way, they are considered high risk and therefore can hard to ensure for a reasonable price. This really is where shopping and comparison has play. There are numerous companies that specialize in insuring high risk drivers at reasonable rates. They're the people who look at you as someone they can help even though you have all messed up before simply because they believe that everyone deserves a second chance. These kind of companies are out there, you merely have to find them.

High risk drivers typically pay more for car insurance because of the reasons mentioned above. However, another reason is that they cannot know there are ways to make themselves more appealing to insurance companies. When someone insures you it's an expansion of trust and all of us realize that trust is something that is earned, not freely given. The important thing is to cause you to appear more trustworthy to insurance companies. This will not offer you good rates right out of the gate because again, it takes time for you to earn trust. However, should you choose a couple of simple things, the cost of your insurance can quickly go down. Proving that you're a responsible and safe driver can go a considerable ways in regards to how auto insurance companies view you and rate you on the risk scale.

To create yourself more appealing to insurance companies, follow these basic tips:

Tip 1: Show that you're sincere in your desire to become a safe and responsible driver who's worth trust. The simplest way to do this would be to enroll in a defensive driver's class, a driver's safety class or both. You must do this of your personal accord and not be court ordered into these classes for it to count as you wanting to sincerely appeal to the insurers. When you have completed this course(s), you are able to take that information to the insurance company and they might lower your rates a bit quickly the bat.

Tip 2: Choose your automobile carefully. Sports and Luxury cars are far more expensive to insure. The higher priced or the more "high end" your automobile is, the more you will purchase your insurance. The safer and more reliable the car is, the less risky it's to insure it irrespective of who the driver is.

Tip 3: Not absolutely all insurance companies look at violations in the exact same way or underneath the same period of time. Speak to a realtor devoted to high risk drivers and discover what they can do for you. You may be surprised!

Tip 4: Check your driving record periodically. Minor violations like speeding stay on your own record for 3 years. Major violations like a driver's license suspensions or a failure to look in court violation stay for 5-7 years. A DUI can last for 7 to 10 years depending on your own state of residence. Knowing your record is much like knowing your credit. Awareness and knowledge can help you keep your rates low.

The best thing for you yourself to do to discover a company that specializes in insuring high risk drivers. Companies like this may do whatever they can to ensure you get the perfect rates and this is exactly things you need now in your life.

What Is Temporary Auto Insurance ?

Temporary auto insurance has been a popular option made available from underwriters in Europe for quite a while given the transient nature of travel through multiple countries. It's only recently become a product which can be made available from North American insurers and it the conveniences and cost savings of short-term car insurance aren't widely known in the American market.

Understanding Temporary Car Insurance

Temporary car insurance emerges on a short term durational basis and offers liability coverage for starters (1) day or up to twenty eight (28) days, although not exceeding thirty days. The policy could be arranged to offer additional coverage for the car during long run travel i.e., a family vacation or for a visiting family member who wishes to operate the car but won't be insured underneath the household policy. Most policies define family as those residing in family members and not extended family members. The cost of a temporary car insurance policy is generally exactly like an annual one but supplies the capability of paying for just what is needed as opposed to locking into (or impacting) an annual plan.

The Economical Alternative

Driver risk factors are the main equation in determining the policy rate for the insurer. A top risk driver includes one that will not have a clear drivers abstract and has demonstrated themselves to be an insurance liability. As this type of young driver or one with a repeat history of claims cannot have a much a lesser premium even when applying for a temporary car insurance policy. However where the choice can conserve money is adding a driver (such as a returning student from college) for a short period of time. Adding a top risk "visiting" driver can have a negative impact on your own annual policy both in terms of your household premium and in case of an accident. However selecting a temporary car insurance product provides adequate liability coverage for the car and the driver for a set duration in the driver's name be very beneficial and prevent negative consequences to the full policy.

Equivalent Liability Coverage

The duration of the auto insurance policy doesn't dictate the level of coverage. For example, the liability coverage of a temporary car insurance policy is strictly equal to a full-time annual policy. Actually the two monthly premiums might be identical (short term insurance policies are rarely discounted in place of annual terms). The service and satisfaction may be the same.

0 Response to "Bobot Tubuh Bertambah, Penampilan Via Vallen Bikin Pangling"

Posting Komentar